The story began in 1983 at the folk high school in Essen, when 12 game exhibitors faced about 4500 to 5000 visitors. Two years earlier, the magazine Spielbox was founded and promoted the initial games fair in 1982, at that time it was still called the German Spielertage. Over the years, the fair gained international attention and this year, at the beginning of October, 147000 people interested in games visited the 980 exhibitors from 56 nations from 6th to 9th October. Since 1990, the German Games Prize has been awarded at the fair, five years after the venue was moved to the fairgrounds of Messe Essen due to the increasing number of visitors, where it has been held almost uninterruptedly every year until today. The year 2020 is an exception, as was the case for many major events at the time, but it still took place online without a visitor presence. With 209,000 visitors and 1,200 exhibitors, 2019 was the record year.

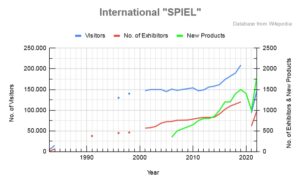

International SPIEL statistics

From '21 to '22, there was indeed an increase in visitors of around 75%, as was highlighted at the press conference. In fact, the number of visitors only reached the level of 2011. If it were possible to predict the number of visitors for 2022 from a trend based on history, one should have expected around a quarter of a million. The reason for this could be the increased number of private gaming events during the pandemic, so that people are currently catching up on other needs. Travel may also have been an issue shortly before the autumn holidays. The extent to which the economic situation has already made itself felt in the private and business sectors can only be seen in retrospect, which also applies to the slump in the number of exhibitors. The presentation of new games has maintained its trend, which is optimistic. But focus on today:

1800 new games or world premieres were presented at SPIEL '22. Games dealing with nature, the environment and animals had a remarkable share at this game fair. But so-called expert games also made an appearance. The trend is towards diversity, according to a brief summary. There was the main share of games worth between 15 and 150 EUR, but there was also a game valued at 400 EUR. Children's games and card games are gaining a higher share again, as are party games. One-person games as well as logic games are strongly represented in customer demand. Thus, a variety of games could be played during the four days of the fair and there were platforms for diverse gaming communities, two of which will be highlighted later. In the area of puzzles, innovations are also emerging. While many puzzles remained on the shelves at the time of the lockdown, the motifs are changing to modern art, game graphics, photos and generally variations in the design of the puzzle itself. Thus, the age distribution of the puzzlers is 60 % adults, consequently 40 % children. The environmental aspect is also evident, as sustainable or recycled materials are used. Multiple outer packaging made of foils and plastics is increasingly being dispensed with. Durable materials and the aspect that games are used for decades generally make it a sustainable product. Gaming continues to be at a high level. Games are one of the two strongest product groups in the toy market, which itself, due to the pandemic, lost seven percentage points in 2022. There was growth in the plush product groups, while outdoor and dolls were less strong. Kidults still have a strong interest in games. Customers are asking for meaningful, creative and challenging playful leisure activities. We found it remarkable that Pokemon-Go and Pokemon collectible card games, a perennial favourite since 2016 and 2000 respectively, presented themselves with their own trade fair stand.

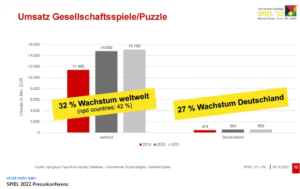

At the press conference for SPIEL '22, there was also information about growth on the games market. The following diagram was shown, which we do not want to leave entirely uncommented. As a reminder, the chart shows the worldwide sales figures in the pandemic period for board games and puzzles. Strikingly, the growth at the beginning of the global lockdown in 2020 by about 30 percentage points. In the follow-up year 2021, however, sales grew by only 2 percentage points. In Germany, the figures are somewhat more slippery, 23 percentage points in 2020 and 3 percentage points increase in sales in 2021, which may be acknowledged as such given the intercepted inflation in Germany.

Turnover Board Games and Puzzles

The toy market, like many other retail sectors, finds itself in transition. Digitalization and e-commerce are forcing even the last to act. The stationary business in the dying inner cities suffers from this and other as well as widely spread problems. The pandemic drove up the share of fixed costs, the subsequent crisis the share, driven by raw material prices, energy, required decarbonization and delivery times / supply chains. Those who had to calculate sharply before now find their profitability even more threatened. As with other product sectors, Germany has so far managed to keep prices low compared to other EU countries, certainly due to the high and good domestic sales market. It is already noticeable how strongly prices have risen for many products. This will also happen with a delay in others and in the toy industry. Personnel is a sensitive issue, there is a lack of skilled workers plus a demographic change. Retailers no longer face competition from their local competitors, but from globalization, which has already moved many shops to open online shops or to offer products on electronic marketplaces. The demands in production, game development and distribution are growing, as is the request for government subsidies to mitigate the financial consequences. For some time now, attempts have been made to offer the games in bookshops, concept stores and the small shops of museums. These were the painful issues that were also addressed at Spiel'22. There was the Educator's Day on the first day of the fair with tailored information for educators and other teachers. Games for teaching, community work and work with seniors were presented here. The Research Day on the following day focused on board game research in Germany. An important support for educational toys and a look into the future.

In order to find their way around the large exhibition site, visitors were provided with an app to help them navigate. Our team from Product Cluster probably felt the same way as many other participants, due to a lack of information on site or in advance, we did not have this useful tool at the start, especially since all the hall flyers were already sold out by noon on the first visitor day. Nevertheless, we find this app very useful.

Navigation App at SPIEL '22

Map of fair SPIEL '22

The industry is expecting growth in Europe again in the next few years, argued by cocooning and the increased stay in family surroundings during times of crisis. According to economic research, Christmas business is not influenced by the current economic situation, so that economic effects wear off. It is important to know that Christmas business accounts for about 40 to 50% of annual turnover.